The Business Owner Experience

At Connecticut Wealth Management (CTWM), our process begins with what matters most: you and your business.

We understand that as a business owner, your personal and professional success are deeply connected. That’s why our team focuses on both, helping you grow your wealth, optimize your business, and plan for what’s next.

Whether you’re preparing for a transition, expanding your business, or simply looking to gain clarity, our approach provides structure, confidence, and a team that’s here to support you every step of the way.

1. Getting to Know You

We start by getting to know you: your values, your goals, and the vision you have for your life. Then we dig deeper into your business: what it means to you, where you see it heading, and any plans for growth, transition, or exit. From there, we partner with you to deliver clarity, confidence, and coordinated planning across all areas of your financial life.

2. Onboarding

Once your goals are clear, our team gets to work. During onboarding, we collect and review your personal and business financial data to gain a full understanding of your starting point and what needs attention. From there, we shift to implementation: opening new accounts, facilitating custodian transfers, and ensuring easy access to your funds. Throughout this process, our service team works alongside you to make the transition smooth, transparent, and stress-free, so you can stay focused on what matters most.

3. Initial Planning

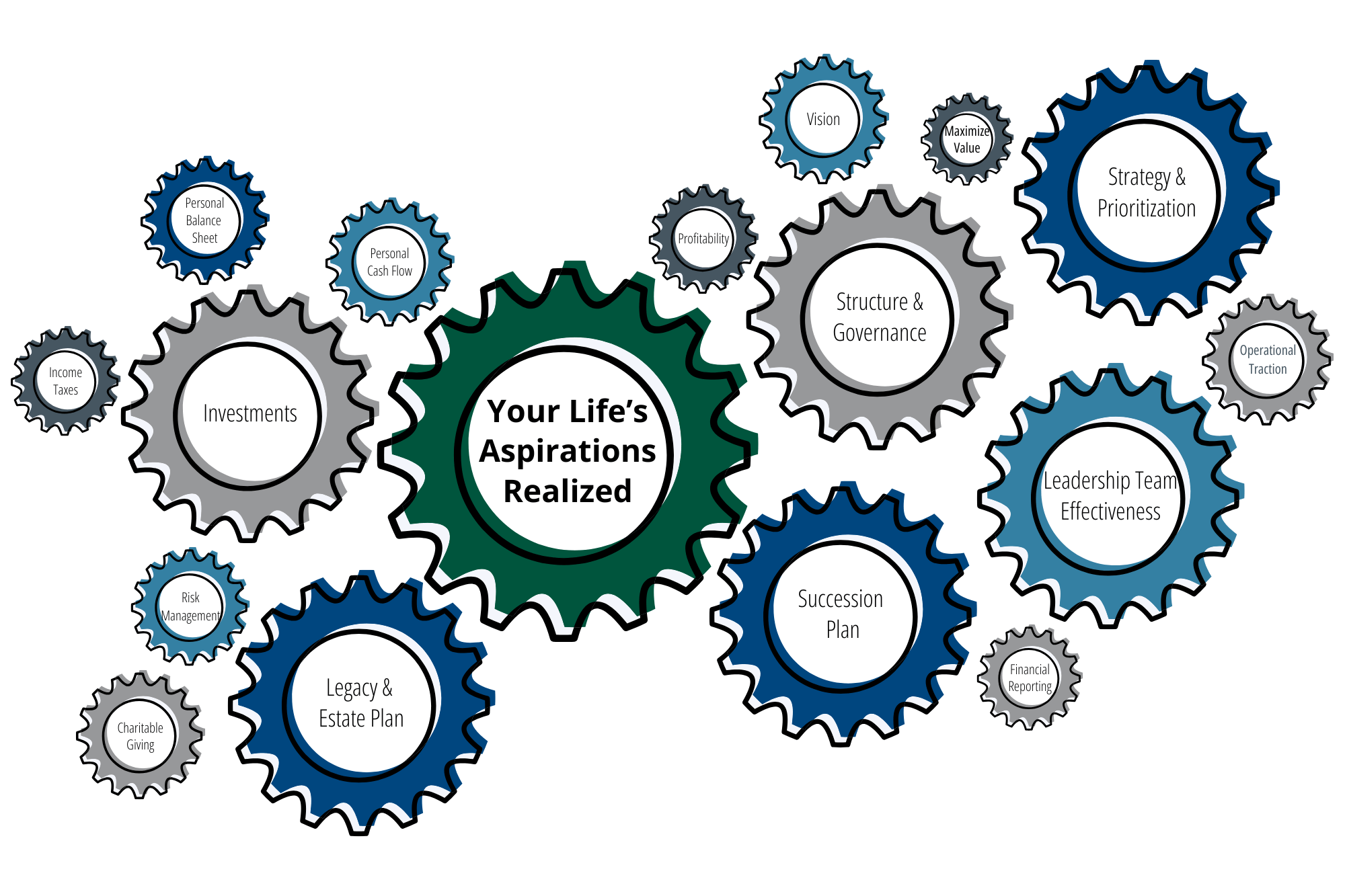

Your plan is built on two core foundations: your personal finances and your business. We address both in parallel to create a comprehensive roadmap toward achieving your life’s aspirations.

Your Personal Finances

While your business may be your biggest asset, your personal financial health is just as important. We evaluate the full picture, including cash flow, risk, investments, estate planning, and more, building strategies tailored to your goals.

Learn more about our personal financial planning process.

Your Business

Your business plays a central role in your financial future. We take a focused look at the areas that drive value and impact your long-term goals. From structure and strategy to succession and leadership, we help ensure every decision supports the future you envision, both personally and professionally.

- Vision: Clarify your business direction and exit timeline. We’ll help you define where you want to take your business and when, so every decision you make supports your long-term personal and professional goals.

- Structure & Governance: Protect your business and decision-making power. We’ll review your ownership structure and governance framework to ensure it supports growth, reduces risk, and positions you for a successful transition.

- Leadership Team Effectiveness: Build confidence in your team’s ability to lead. We’ll help you assess your leadership bench, identify any gaps, and develop the team that will drive your business forward — with or without you.

- Strategy & Prioritization: Focus on what matters most. Together, we’ll align your business goals with actionable strategies and help prioritize where to invest your time, energy, and resources for maximum impact.

- Operational Traction: Gain clarity and consistency across your business. We’ll help strengthen your systems and processes to improve accountability, efficiency, and execution at every level.

- Succession Plan: Secure your company’s future beyond your leadership. We’ll guide you through the succession planning process, from identifying successors to implementing a plan, so your legacy is protected.

- Financial Reporting: Make confident, informed business decisions. We’ll work with you and your team to ensure your financials are timely, accurate, and easy to understand, giving you the insight you need to run and grow your business.

- Maximize Value: Understand what drives your company’s value. We’ll help you assess current valuation drivers, uncover risks, and take strategic steps to strengthen your business’s worth in the eyes of future buyers or successors.

- Profitability: Maximize the return on your hard work. We’ll identify ways to improve margins and increase profitability, so you’re not just building a successful business — you’re building personal wealth.

4. Ongoing Partnership

As your life and business evolve, we’re here to make sure your financial plan evolves with you. That’s why our partnership is built around annual goal and strategy setting, ongoing planning, and a meeting cadence that fits your needs. We stay actively engaged throughout with personalized touchpoints and timely insights, keeping you informed, aligned, and accountable. Behind the scenes, your dedicated team is continuously tracking progress and adjusting strategies, so you can stay focused on what matters most.