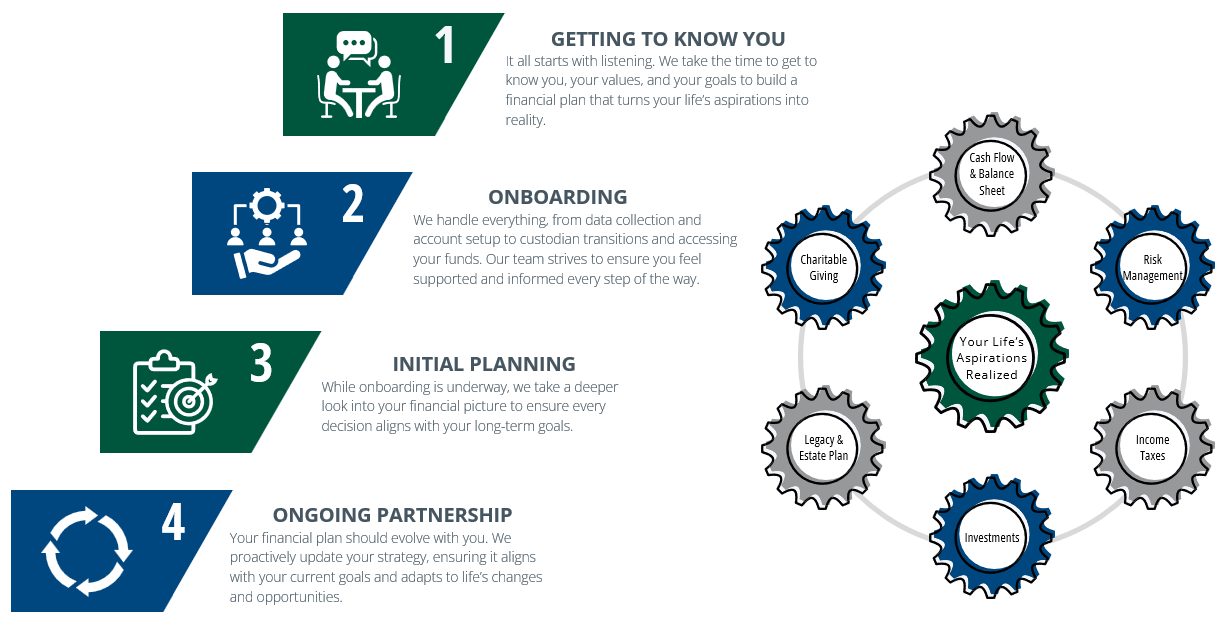

The Client Experience

At Connecticut Wealth Management (CTWM), our process begins with what matters most: you.

We believe that solid planning doesn’t stop at a single moment, it’s an ongoing partnership. From our first conversation and throughout our relationship, we provide a clear roadmap, personalized strategies, and proactive support that evolves with you.

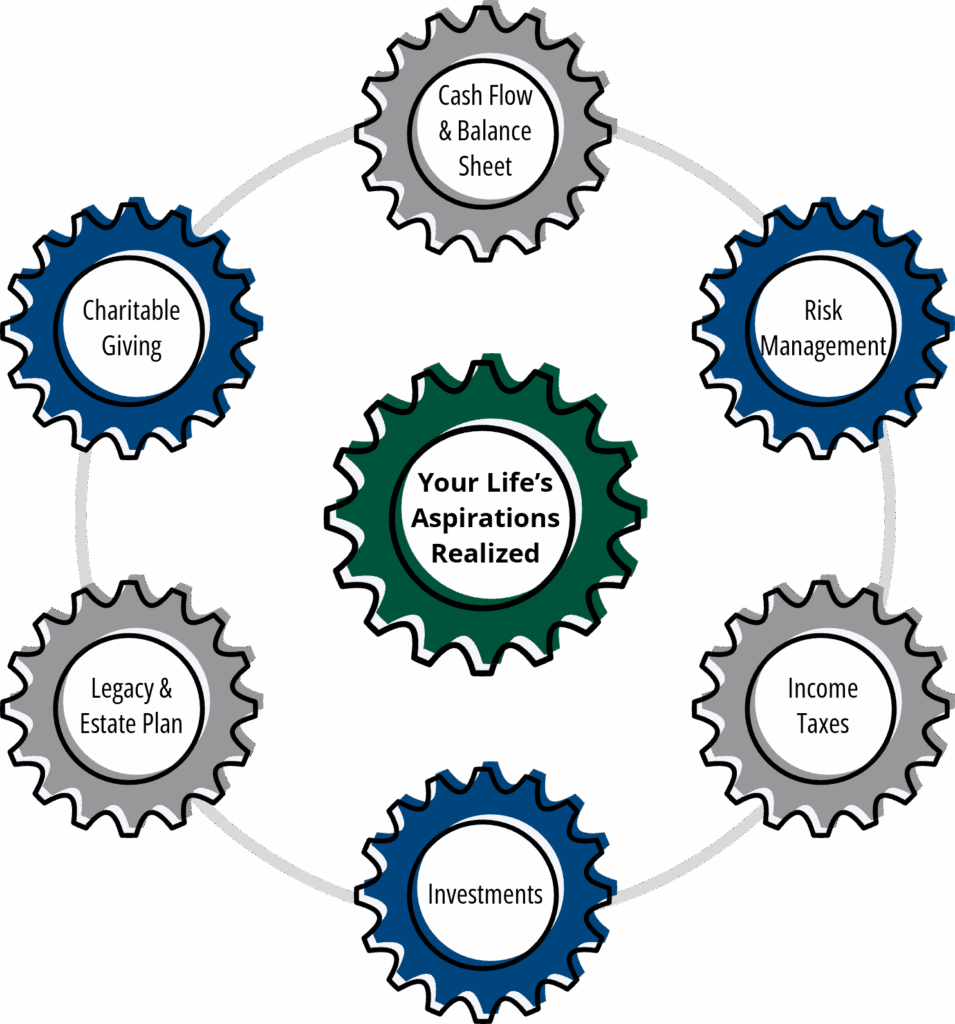

While you’re focused on your life, career, and family, we’re focused on turning your life’s aspirations into reality.

1. Getting to Know You

It all starts with listening. We take the time to understand your values, story, and what you hope to achieve to give us a full understanding of where you are today. Together, we’ll develop a personalized financial plan designed to provide you with clarity and confidence.

2. Onboarding

Once your goals are defined, we get to work. Our team reviews every aspect of your finances to craft a personalized plan while our dedicated service team works to ensure a smooth transition. We take care of everything from account setup and custodian transfers to accessing your funds, ensuring you feel supported and informed.

3. Initial Planning

While onboarding is underway, we dive into the key areas of your finances, developing a clear picture so every decision is strategic and aligned with your goals.

- Cash Flow & Balance Sheet: Understand where you stand financially. We’ll help you understand your income, expenses, assets, and liabilities, so you can manage your cash flow effectively and optimize your savings for the future.

- Risk Management: Gain confidence knowing your wealth is protected. We’ll help you identify potential risks and find the right insurance coverage and safeguards that fit your needs.

- Income Taxes: Lessen your tax burden by taking advantage of tax-saving opportunities. We’ll work with you to develop long-term strategies to reduce your tax burden and preserve your wealth.

- Investments: Feel confident knowing your portfolio is rooted in your goals and risk tolerance. We’ll develop and manage a personalized investment strategy tailored to your goals, guiding you toward financial security over time.

- Legacy & Estate Plans: Gain peace of mind knowing that your wealth will be passed on according to your wishes. We’ll review your estate plan and beneficiary designations, working to minimize potential complications so your legacy is protected for generations to come.

- Charitable Giving: Create a giving strategy that reflects your values. We’ll help you design a plan that maximizes the impact of your donations and provides tax benefits, so your wealth can make a lasting difference.

4. Ongoing Partnership

Your life evolves, and so should your financial plan. As markets shift or your life circumstances change, we’re here to adapt your plan. Through ongoing reviews and timely check-ins, our goal is to help ensure your strategy remains aligned with where you are today and where you want to go.

Want to see what your financial journey with Connecticut Wealth Management (CTWM) could look like?

Let’s start the conversation.