A little goes a long way. Perhaps, a phrase many of us can relate to in some way whether we’re referring to a change in our spending habits, showing kindness to a stranger, or adding hot sauce to our dinner. Our investment committee works tirelessly to find opportunities, big and small, to drive better outcomes in the portfolios. In this pursuit, we will be implementing an update over the coming weeks to replace the Vanguard S&P 500 Growth Fund and the Vanguard S&P 500 Value Fund with expense ratios of .14% to another mutual fund company that offers the exact same exposure at .04%. You will now see the SPDR S&P 500 Growth and Value Fund as core holdings wherever there is an opportunity to make the change without incurring a tax liability. For many of our clients, this will mean the trade will only occur in retirement accounts where capital gains are not a consideration.

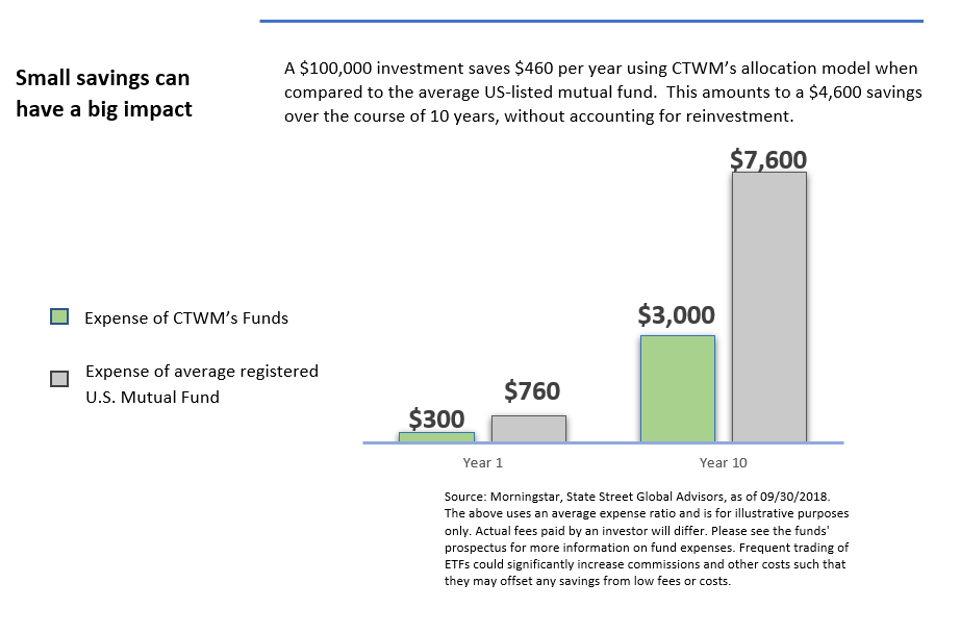

This move brings the investment expense ratio of our average portfolio down to .30% versus the average expense ratio of all US-listed mutual funds at .76%. Here’s how that savings plays out over time on a $100,000 investment:

We believe that every basis point counts when it comes to your financial goals.

Although the geopolitical environment has become more challenging almost overnight, the pillars of fundamental investing still appear sound. We will continue to monitor the impact of trade developments but rest assured that your portfolio is designed to weather this type of market activity. As always, feel free to call us with any questions or concerns.

The foregoing content reflects the opinions of Connecticut Wealth Management, LLC and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.