As 2024 winds down, strong market performance and the upcoming election are prompting questions about navigating volatility, potential changes to estate taxes, and market impacts from policy shifts.

In our most recent update from our Investment Committee, the team discusses key insights and proactive steps to help you stay aligned with your financial goals amid an ever-changing landscape.

- Strategies for Navigating Volatility

- 2024 Election: Impact on Estate Taxes

- 2024 Election: The Market Impact

Strategies for Navigating Volatility

Overall, 2024 has been a strong year for the stock market, despite ongoing calls for a recession. The global stock market has risen by over 30% in the past year, while the broad bond market has gained more than 11%. Diversified portfolios (with a 60% allocation to stocks and 40% to bonds) have seen returns exceeding 20% during this period, according to Morningstar Direct.

This strong performance has left many investors questioning their next steps. Should I go to cash? Should I wait for the market to drop before investing? While volatility is inevitable, historical data shows that even investing at market highs can yield favorable returns over time.

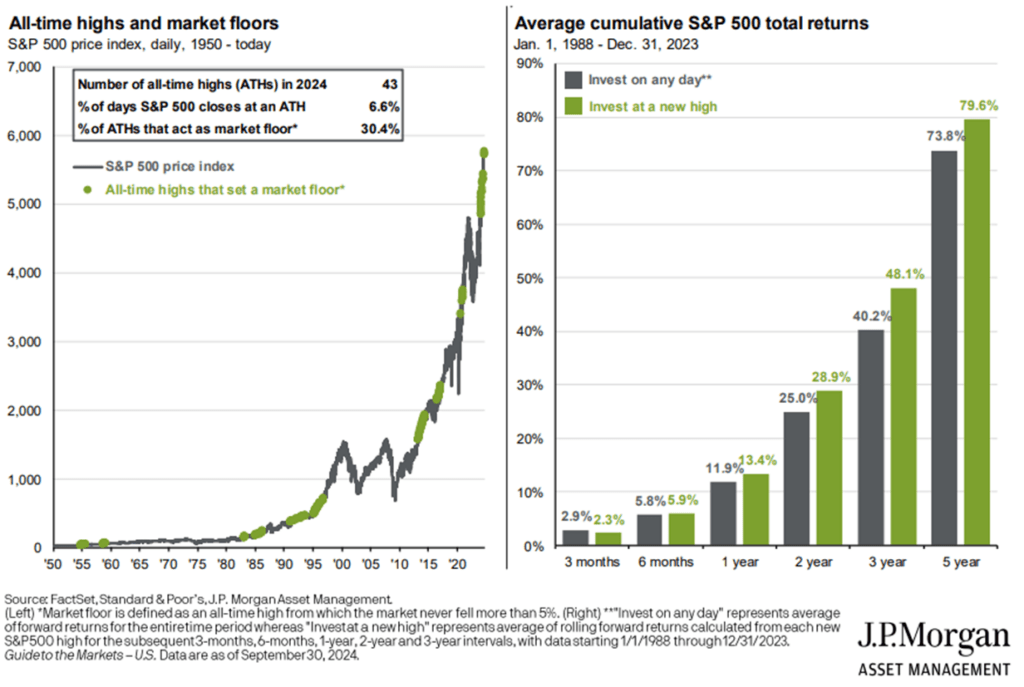

The accompanying charts highlight that we should not avoid investing simply due to the market hitting all-time highs; rather, they often signal the potential for further all-time highs.

The chart on the left illustrates that 30% of the time, reaching an all-time high establishes a new market floor, which is signified by the green dots. Once this floor is set, the market has not dropped more than 5% below that point, representing that reaching these all-time highs can act as a support level for future market movements.

While investing at all-time highs may feel risky, the data on the right side of the chart shows that investing at these levels still tends to yield strong returns. In fact, the difference between returns from investing at all-time highs versus on any random day is not as significant as some might assume. In certain periods, investing at all-time highs can result in comparable or even better long-term returns than trying to time the market.

“We believe deeply in understanding your cash needs from the portfolio and in turn ensuring that your portfolio is serving your financial objectives,” said John Shanley, Partner and Managing Advisor at CTWM.

Our investment approach aims to prepare our clients for their short-term cash needs while maintaining a focus on long-term goals. Your advisor can help ensure your financial strategy aligns with your needs and goals.

2024 Election: Impact on Estate Taxes

As the 2024 election approaches, candidates are making headlines with their policies and proposals. Among these items, one that could have an impact on our clients is potential changes to estate tax exemptions.

Currently, an individual can pass up to $13.61 million to their heirs without incurring estate taxes. However, this exemption is set to expire at the end of 2025, and if left unchanged, the limit will be reduced to a threshold of approximately $7 million.

The Trump campaign aims to extend the current estate exemption indefinitely and has discussed potential increases in the future. The Harris campaign intends to let the exemption expire as planned, which would result in more individuals being subject to the estate tax.

In preparation of either scenario, we are proactively reviewing each client’s individual financial situation and estate plan. This includes updating balance sheets and property values to better understand how these potential changes may affect our clients’ net worth.

Additionally, we are performing comprehensive reviews of existing estate documents to ensure clients have the right trust and inheritance strategies in place. In some situations, it may make sense to gift assets to family members now to reduce exposure to future estate taxes.

“Our team is focused on understanding the impact of these changes and is proactively reviewing clients’ financial plans to identify opportunities that align with their goals,” said Megan Trask, Partner & Managing Advisor at CTWM.

2024 Election: The Market Impact

Outside of the impact of the election on financial planning, we also are frequently asked about the potential impact on broader financial markets. While markets often experience short-term fluctuations in response to policy changes, studies have shown that they tend to stabilize over time, and regardless of who is in office, markets tend to go up.

There are two key policies that we see as potentially having an effect on the markets – taxes (on the corporate side), and trade (tariffs in particular)

Regarding corporate taxes, the Harris campaign is proposing raising the current 21% rate to 28%, which is still below the previous rate of 35%. Meanwhile, the Trump campaign is proposing to reduce the rate to 15%. In the short term, a change in tax rates can impact company earnings, which can flow through to impacting broader valuations in the market. However, corporations tend to find ways to structure themselves in ways that reflect tax policies.

The second policy item under scrutiny is trade. The Harris campaign has expressed its interest to keep the “tough on China” position, with the potential to impose targeted tariffs on certain Chinese imports, some rumored to focus on steel and aluminum. In contrast, the Trump campaign has proposed a 60% tariff on Chinese imports as well as a 10% baseline tariff on all other imports. Tariffs can generate additional activity within our borders, but until the infrastructure is in place to meet more market demand, it could lead to higher prices and the potential for a resurgence in inflation.

We maintain a long-term investment perspective, monitoring key developments along the way. We continue to focus on quality in portfolios – both on the corporate earnings and cash flow side for stocks, as well as credit quality for bonds. As we get through the election, our Investment Committee will be meeting frequently to see how policy changes will impact our long-term themes, and any potential portfolio shifts that are needed.

“We remain focused on the longer-term market cycle,” said Trask. “It comes back to the planning work we do – understanding your cash needs and ensuring those needs are protected within the portfolio.”

Wrapping Up

In times of market uncertainty and shifting policies, staying focused on your long-term financial plan is essential. At Connecticut Wealth Management, we are here to help you stay on track—whether that means navigating market volatility, preparing for tax changes, or adjusting to shifting economic conditions.

Have questions or want to learn more about CTWM’s services? Contact our advisors at 860-470-0290 or by completing the form.

Disclosures

This material is for informational purposes only. Data and statistics contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed. Our statements and opinions are subject to change without notice. Always consult with a professional before taking specific investment action. Always consult with a legal, tax or insurance professional before taking specific action.