In the most recent update from CTWM’s Investment Committee, John Shanley, Partner and Managing Advisor, and Josh Sweeney, Director of Investments, explore how leveraging money markets can help position your portfolio for long-term success and the strategic benefits of holding fixed income.

The Money Market Landscape

You see it all over the news – interest rates have risen globally. Yet, an ongoing topic of conversation with many of our clients is how large banks are paying the same near-zero percent yield in their offerings of checking and savings accounts.

While traditional banking has its place for managing your financial needs, a byproduct of the current interest rate environment is that money markets are providing an opportunity for yields that are substantially higher than those of traditional banks.

As part of your financial plan, your CTWM advisor can help you identify the appropriate level of cash to hold by assessing your individual needs in the short-to-medium term (1-2 years). After determining your cash need, we can drill down into how much cash should be left in traditional bank accounts, and your advisor can discuss opportunities for adding cash to CTWM accounts to ensure you are earning the appropriate market rate on these funds.

Accounts at CTWM have access to at-or-above average yielding money markets, with same day settlement. This means that excess savings can be held in these accounts and generate a much higher yield than those offered in traditional bank accounts while still being easily accessible if cash is needed unexpectedly.

Additionally, our Investment Committee regularly reviews all account cash balances, looking for opportunities to trade client assets in the most preferred money market given their unique situation. This process helps us to ensure that our clients are earning what they should and taking advantage of the current market environment.

Why Do We Own Fixed Income?

Over the last 5 years, bonds have underperformed investor expectations. As of June 30, 2024, the Bloomberg Aggregate Index has produced a negative annual return. Stocks, on the other hand, have proven to be resilient with the S&P 500 Index returning over 15% per year over the same time period.

Given these figures, a more frequent question asked is why we continue to hold bonds in our target portfolio.

If we look further back, historically bonds have provided stability during volatile markets, increasing in value as stocks decline, and providing a source of income for those in distribution mode.

However, in 2022, the dynamic shifted. The Fed’s interest rate hikes pushed down the value of existing lower-yielding bonds to combat post-COVID inflation. At the same time, these rising interest rates hurt the equity markets, pushing down two key components of client portfolios. This shift contradicted the historical interaction between stocks and bonds, where their opposing movements typically provide the added benefit of diversification.

Since this time period, equities have rallied, while bonds have struggled to keep pace with rates continuing to rise as the Fed has focused on bringing down inflation. Returns over the most recent 3 and 5-year time periods have caused investors to question why we continue to hold bonds.

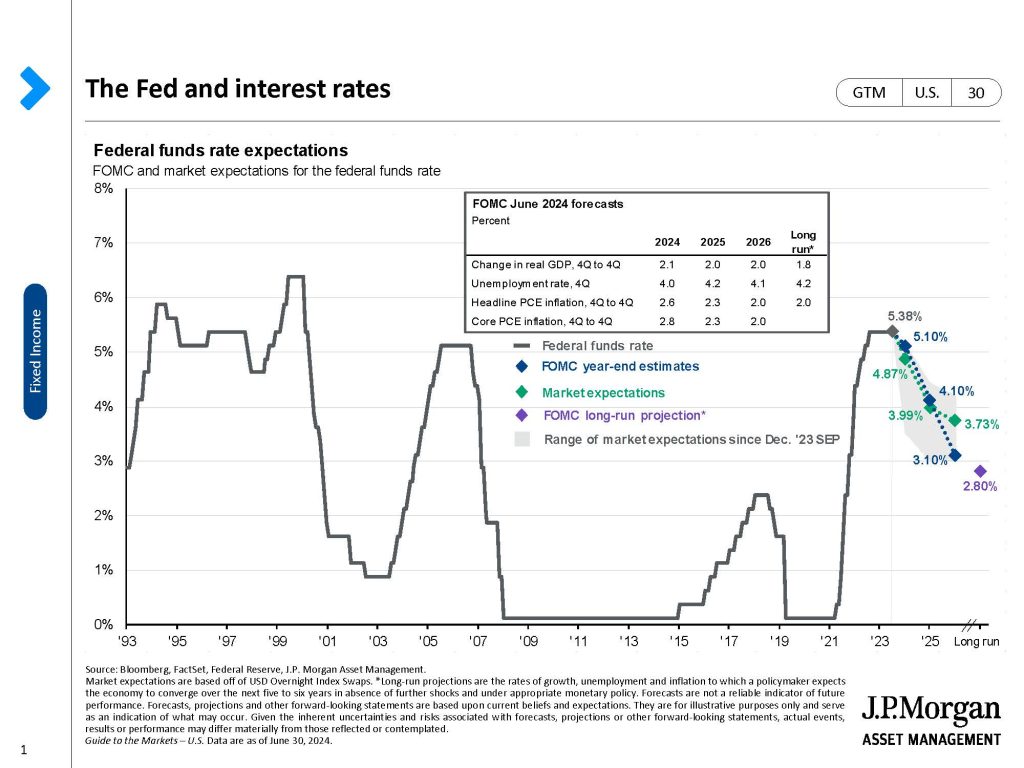

Fast forward to today, we as investors need to consider the expectations looking forward, not backward – more specifically focusing on the predictions of interest rate movements in the near term. The chart below highlights market expectations and the Fed’s target for future rates.

The prevailing theme expressed is the expectation for interest rates to come down soon. However, this has been an expectation since early 2023, so the timing remains uncertain.

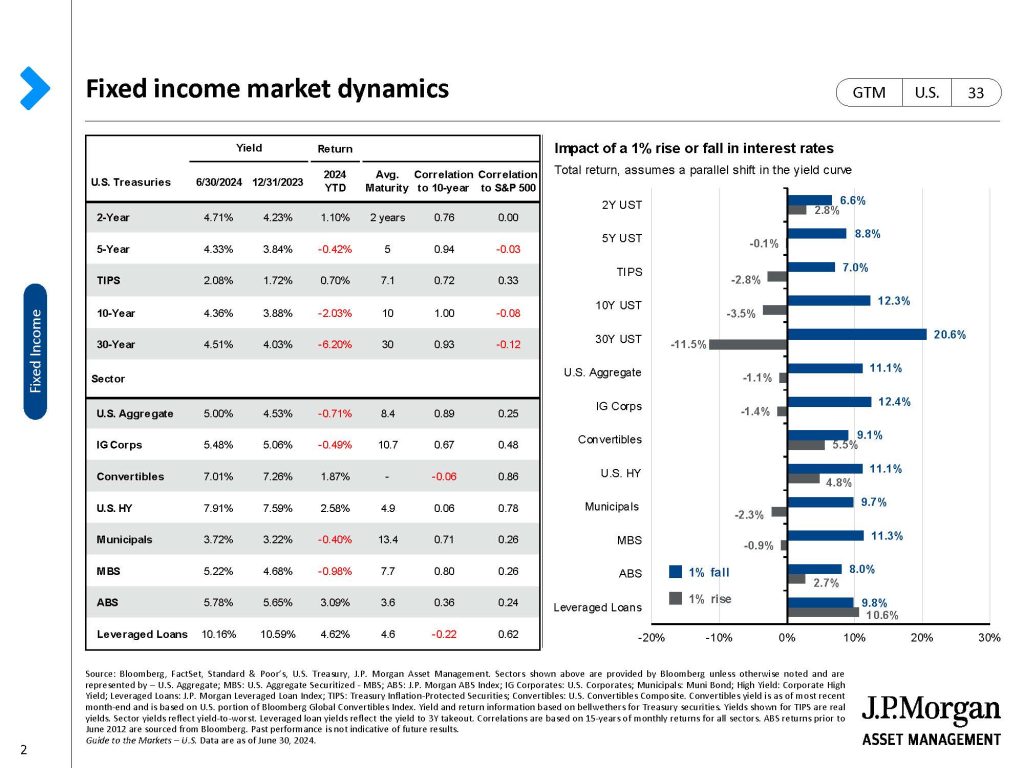

The second chart below shows how different types of bonds would react to a hypothetical 1% change in interest rates. The highlighted sections represent areas of the market that our CTWM Target Portfolios have exposure to.

The main takeaway of these charts is to evaluate the downside risks if rates were to unexpectedly increase versus the potential earnings if the market is correct and we do see a series of rate cuts. Given the credit quality of the bond positions we hold at CTWM, the potential rewards appear extremely attractive relative to the risks.

Lastly, we also need to evaluate what happens if rates were to stay elevated for a longer period of time. In this scenario, current bonds offer an attractive yield compared to recent time periods, allowing clients and investors to continue to generate attractive income even if current expectations do not come to fruition.

Despite the recent performance challenges, we believe diversified portfolios with fixed-income holdings should experience less downside and offer the ability to rebound quicker if there is market volatility. With potential risk events on the horizon, bonds remain a key part of our investment strategy, especially given their current return potential.

Wrapping Up

Connecticut Wealth Management’s (CTWM) goal is to provide you with a complete picture of your financial standing. Although some of these opportunities and changes may seem small, we believe they have a much larger impact on your long-term goals.

Have questions or want to learn more about CTWM’s services? Contact our advisors at 860-470-0290 or by completing the form to start planning your financial future.

Disclosures

This material is for informational purposes only. Data and statistics contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed. Our statements and opinions are subject to change without notice. Always consult with a professional before taking specific investment action. Always consult with a legal, tax or insurance professional before taking specific action.