Market volatility can feel unsettling, especially when so much is riding on your financial future. But for high-net-worth investors, uncertainty doesn’t have to mean instability. With a thoughtful, long-term plan in place, you can stay focused on what matters and turn short-term disruption into opportunity.

In a recent conversation with Charles (Chip) Olson, Partner & Managing Advisor at Connecticut Wealth Management (CTWM), we explore how investors can navigate uncertainty with clarity and confidence.

What Is Market Volatility?

“Think of market volatility like turbulence on an airplane,” said Olson. Just as a plane stays on course despite turbulence, a well-structured financial plan and a diversified portfolio can withstand market fluctuations.

However, volatility isn’t always negative; it can also present opportunities.

“There were no expectations that stocks would perform as well as they did in 2023 and 2024,” said Olson. Yet, the S&P 500 posted gains of over 26% in 2023 and over 25% in 2024, a powerful reminder that even after uncertainty, markets can rebound unexpectedly.

At CTWM, we reinforce the bigger picture by reminding clients that market downturns are a natural part of investing. Our advisors guide clients through uncertainty, keeping their plan on track despite short-term market movements.

How Volatility Impacts More Than Returns

Financial uncertainty doesn’t just affect your portfolio, it can weigh heavily on your mind. Regardless of your net worth, when market movements are pronounced, emotions can run high, and fear or panic can lead to reactive decisions.

“Our job as advisors is to ground our clients in their financial plan,” said Olson. “There will always be volatility, but as long-term investors, we must remember that fluctuations are normal and we can help mitigate this through sound planning.”

For business owners, there’s no clear line between personal wealth and business success. Economic uncertainty affects both, impacting cash flow, operating earnings, and long-term growth prospects. By understanding these dynamics, our team builds thoughtful strategies to help protect both their financial futures and support the continued growth of their enterprises.

Planning: The Foundation for Confidence

At CTWM, we believe that the best way to prepare for uncertainty is with a comprehensive financial plan tailored to your unique needs and goals.

“Our approach is planning-centric,” said Olson. “The first thing we do is ensure our clients have a sound financial plan in place that takes into account a variety of market environments they may experience throughout their lifetime.”

Our advisors leverage advanced stress-testing techniques, such as Monte Carlo simulations, to model a portfolio’s performance across a range of market conditions. This proactive approach helps reassure investors that their plan can withstand both market instability and unexpected economic shifts, providing a foundation for navigating uncertainty.

The Power of Diversification

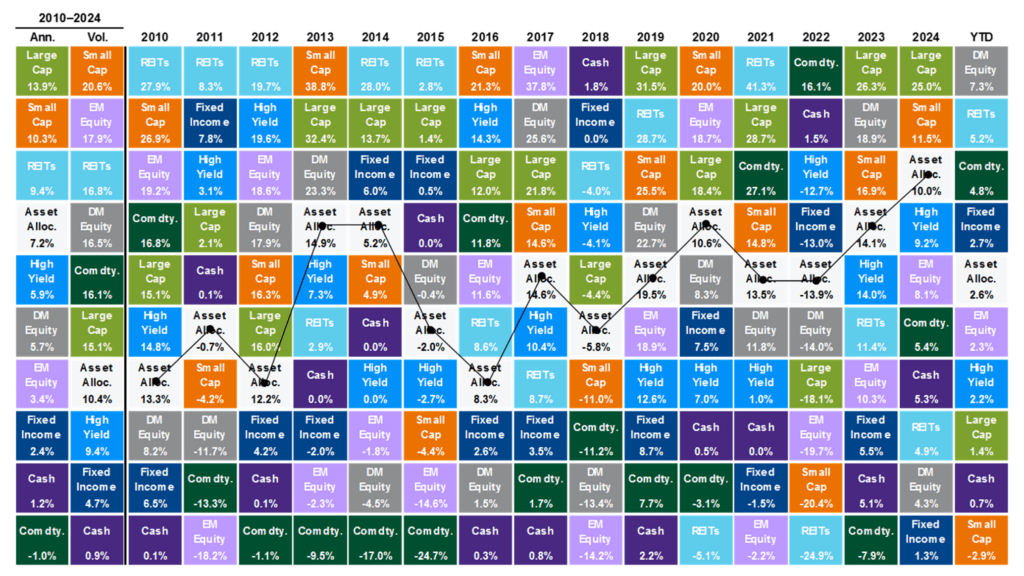

We believe that diversification is an effective way to manage market volatility and protect long-term wealth.

“A well-diversified portfolio, which is an appropriate mix of stocks, bonds, alternative investments and cash, provides both growth potential and downside protection,” said Olson. Stocks may experience greater swings but can drive long-term returns. Bonds negatively correlated assets and cash, on the other hand, can offer stability, especially during downturns.

As the chart below illustrates, a balanced portfolio of 60% stocks and 40% bonds tends to move with less volatility than the broader equities market.

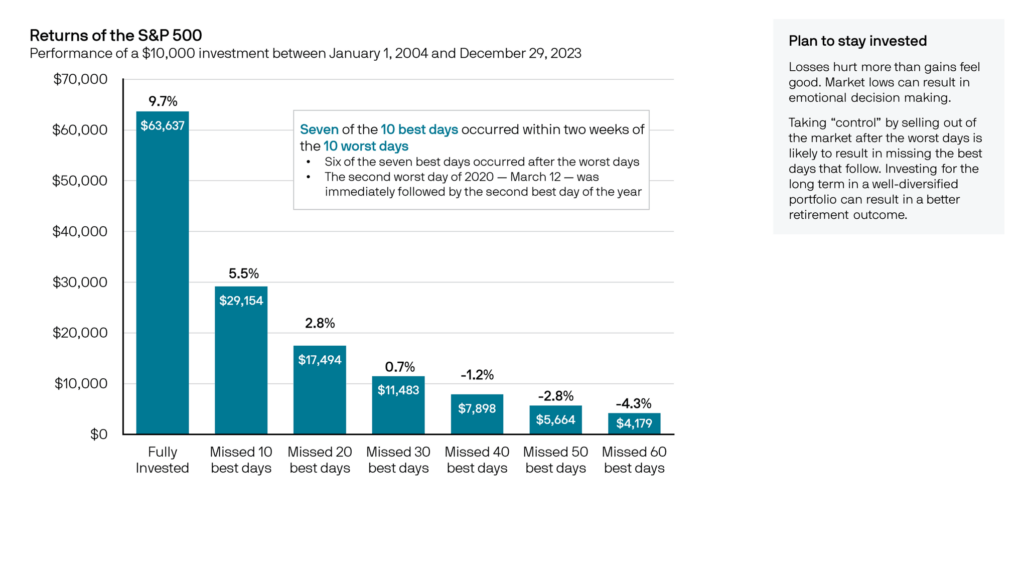

History also shows that missing just 10 of the market’s best days can significantly reduce returns, as illustrated in the chart below. This is why we believe that staying fully invested through volatile time periods, rather than panicking and selling, is key to long-term growth.

At CTWM, we build diversified portfolios based on clients’ goals, retirement timeline, and tolerance for risk. This thoughtful balance helps ensure their portfolios can pursue growth while weathering the inevitable ups and downs.

How CTWM Can Guide You Through Volatility

Even seasoned investors can feel uneasy when markets swing sharply. But with a plan built to absorb uncertainty, you can stay focused on your life’s aspirations and turn potential challenges into opportunities.

At Connecticut Wealth Management (CTWM), we take a proactive, strategic approach to guiding clients through market fluctuations. By maintaining liquidity for short-term needs and identifying opportunities during market shifts, such as tax-loss harvesting or rebalancing portfolios, we help clients stay on track without reacting impulsively to market swings.

Our investment philosophy is rooted in comprehensive planning and diversification —helping to avoid emotional or impulsive decisions. If you’re ready to navigate volatility with confidence, our team is here to guide you every step of the way. Contact our team today to learn more about how we can help you turn market challenges into opportunities for long-term financial success.