At Connecticut Wealth Management (CTWM), we believe that staying invested and diversified is essential, especially in unpredictable years like 2025.

In our latest Investment Committee update, John Shanley, Partner & Managing Advisor, and Josh Sweeney, Director of Investments, break down the current market environment and how our investment approach is designed to provide stability amid uncertainty.

Their message is clear: even when markets take unexpected turns, a diversified portfolio can help you stay on track toward your life’s aspirations.

An Important Mid-Year Lesson

We’re halfway through 2025, and the markets have not played out the way many investors expected.

At the start of the year, optimism around “U.S. exceptionalism” was widespread, mainly due to expectations of lower corporate taxes, fewer regulations, and a generally pro-business agenda from the new administration.

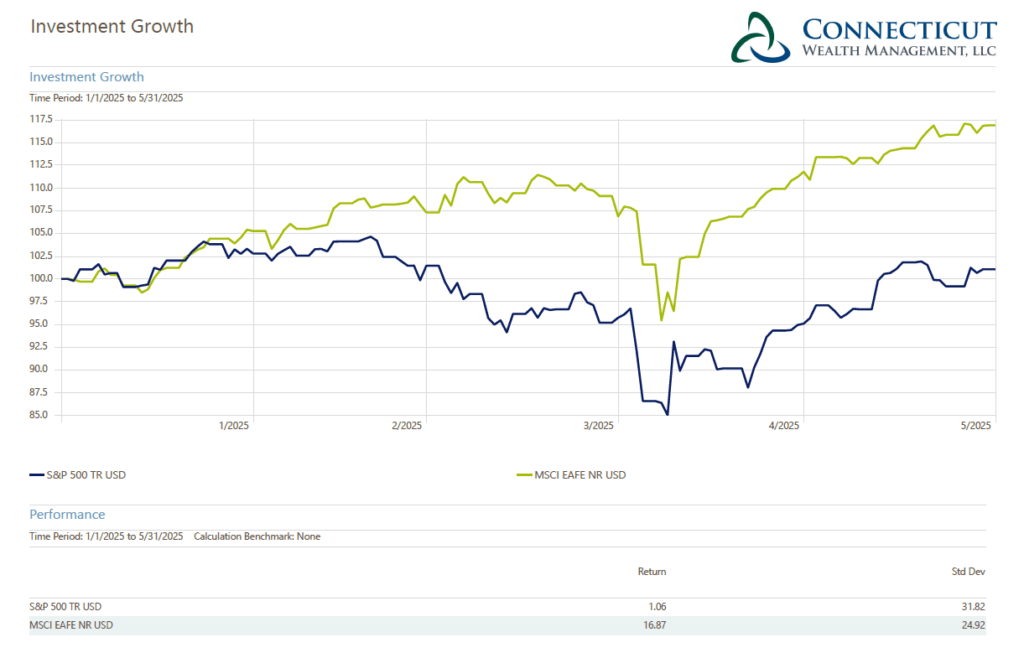

However, as tariffs shifted to center stage in early 2025, we saw a reversal of this narrative, shifting instead towards a trade of anything but U.S. assets. By the end of May, international markets were up nearly 17% while U.S. markets were up just over 1%.

At CTWM, we don’t chase the “next best asset class.” Instead, we build well-diversified portfolios designed to adapt to changing market conditions.

Despite the strong focus on U.S. equities in 2023 and 2024, and questions about why portfolios aren’t 100% allocated to them, we’ve remained committed to diversification. In 2025, that discipline is proving its value. Markets ebb and flow, and the most consistent way to navigate those shifts is by staying diversified and staying aligned with your financial plan.

Not Always First, But Rarely Last

The current negative market sentiment has many CTWM clients saying: “Given everything going on, I’m surprised my portfolio isn’t doing worse.” We believe the answer to this surprise lies in our disciplined, long-term approach to utilizing diversification in portfolios.

In 2023 and 2024, U.S. market performance was largely driven by seven companies, commonly referred to as “the Magnificent Seven”. While certain companies can have a huge impact on the global economy, markets tend to move in cycles.

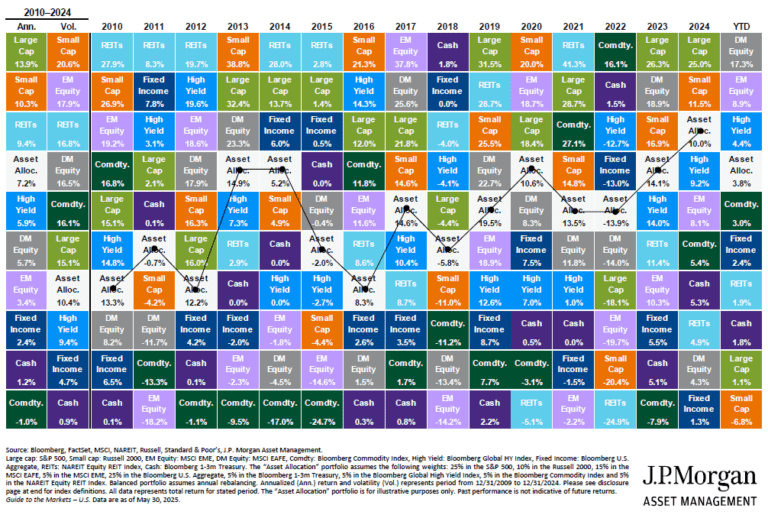

Over long periods, two, three, or five years, different asset classes show outperformance. Accurately predicting which one is going to be a top performer is extremely difficult, as evidenced by the challenges active managers have holding onto assets. This is why diversifying your portfolio and having exposure across many areas of the market is essential.

The “Quilt chart,” pictured below, shows the rankings of asset class performance each year. While some categories surge and others fall, one stands out for its consistency: the white box, which represents a diversified asset allocation portfolio.

Staying Disciplined for the Road Ahead

Even with more clarity than we had in January, the second half of 2025 will likely bring new surprises and more market volatility.

That’s why we remain focused on building diversified portfolios that are aligned with your long-term financial plan. These portfolios maintain exposure to a broad range of asset classes—U.S. and international stocks, bonds, and alternatives—so no single market sector’s movement dictates your portfolio’s overall outcome.

This focus on diversification has historically helped reduce volatility and smooth the ride over time. While a diversified portfolio will likely not always lead in performance, its consistency is what helps clients stay invested and focused on the bigger picture.

Our Investment Committee continues to monitor the markets and make thoughtful adjustments when needed, but never in response to headlines or short-term noise. Instead, we stay grounded in your plan and committed to helping you reach your goals, regardless of what the markets are doing.

If you have any questions or would like to revisit your strategy, your CTWM advisory team is always here to help.