At Connecticut Wealth Management (CTWM), we understand that times of market uncertainty can bring a sense of unease. Our goal is to reassure you that our team is here to help guide you through these challenges and prepare for the unknown in the current market. By focusing on long-term strategies that align with your financial plan, we aim to provide a sense of confidence that your portfolio is equipped to handle market volatility, while not putting your life’s aspirations and goals at risk.

In the most recent update from our Investment Committee, John Shanley, Partner & Managing Advisor, and Josh Sweeney, Director of Investments, discuss how our disciplined approach to diversification and proactive portfolio adjustments reflect our thoughts on navigating the current market landscape.

Staying the Course Amid Market Uncertainty

As 2025 unfolds, the market has taken a different path than many expected. U.S. stocks have pulled back from their 2024 highs, and political uncertainty has reached levels not seen since the COVID-19 pandemic.

In recent days, the U.S. has imposed tariffs on trade with many countries across the globe. Although some level of tariffs was anticipated, the impact surpassed expectations, causing notable declines in global markets. With the long-term effects and implementation details still unclear, this development adds to the already overwhelming uncertainty among investors.

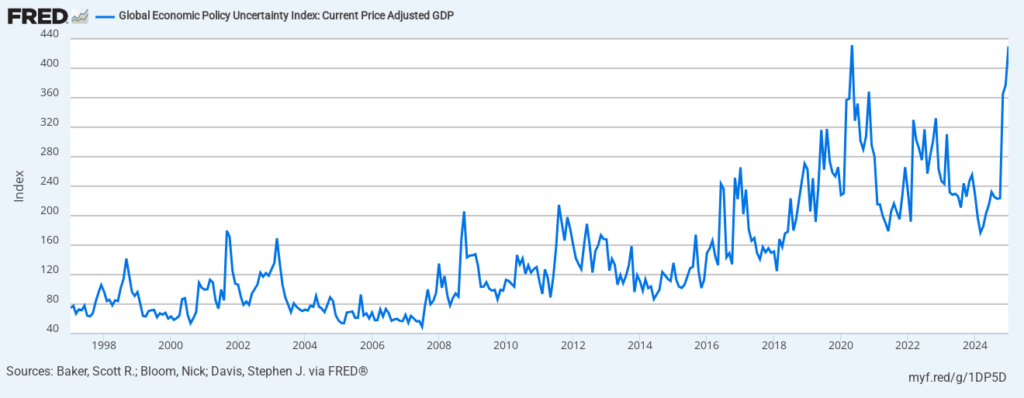

“That feeling of uncertainty is justified,” said Shanley. As illustrated in the chart below, the Global Economic Policy Uncertainty Index reflects this unease as ongoing discussions on global policy create ripple effects across industries.

While volatility is expected in any presidential election year, 2025 has already shown more movement than most market specialists anticipated. Shifting trade policies could further influence inflation trends, while geopolitical instability continues to impact certain market sectors. Additionally, structural changes within the U.S. government add another layer of uncertainty, with long-term effects still yet to be seen.

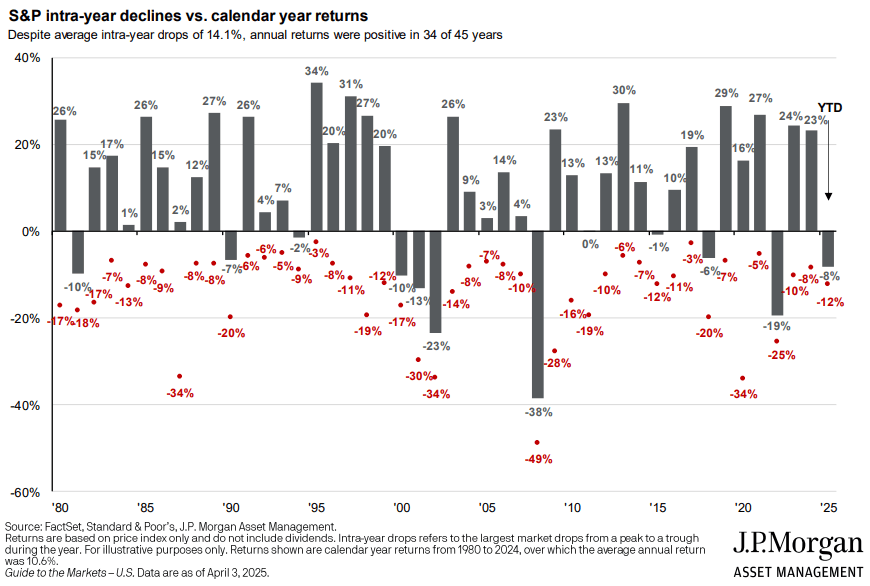

Despite these challenges, history reminds us that market corrections are a normal part of investing. Even in strong performance years, intra-year declines are common, as shown in historical market performance data of the S&P 500 since 1980.

“We really believe that our job as financial planners is to prepare, not necessarily predict,” said Shanley. “We focus on having your financial plan lead your investment portfolio.” Diversification and meeting cash needs remain at the core of our approach, helping our clients to navigate uncertainty with confidence.

Proactive Portfolio Adjustments for 2025

We understand that market swings can feel unsettling. With heightened market volatility, you might be asking yourself: What does this mean for my portfolio?

“Our priority is to help provide clarity and stability, making decisions with your long-term goals in mind—regardless of the market environment,” said Shanley.

Our Investment Committee anticipated increased volatility with the new political administration and proactively adjusted our target portfolio to help manage risk and navigate potential market uncertainty.

In terms of risk management, given our expectations of more pronounced market movements in 2025, we made a few adjustments to portfolio allocations. We reduced exposure to small-cap and emerging markets, which tend to have more pronounced reactions to market movements, and shifted those investments into mid- and large-cap U.S. stocks, which have historically provided greater stability during uncertain periods.

One additional move was replacing a large-cap holding with a more cost-effective option, reducing the expense ratio from 0.15% to just 0.015%. We believe this adjustment aligns with the investment industry’s emphasis on keeping fees and expenses low, ultimately helping our clients save more over the long term.

Through it all, our team’s focus remains on keeping our clients well-positioned for the long term. Our advisors will continue to prioritize your cash needs to help weather short-term market swings, and our Investment Committee will continue to monitor evolving market conditions and make thoughtful adjustments as needed. By staying disciplined and proactive, our goal is to help our clients navigate these periods of uncertainty.

Looking Ahead with Confidence

At Connecticut Wealth Management (CTWM), we are committed to being a supportive partner in your financial journey. While market volatility is part of the investing process, please know that our advisors are always here to listen, make adjustments, and help you feel confident in your financial plan. If you have any questions or concerns, please do not hesitate to contact your advisory team.

Disclaimers:

Past performance is not a guarantee of future results. Inherent in any investment is the potential for loss.

Certain information contained in this document may constitute “forward-looking statements,” which can be identified using forward-looking terminology such as “may,” “will,” “should,” “expect,” anticipate,” “project,” “estimate,” “intend” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any strategy or market sector may differ materially from those reflected or contemplated in such forward-looking statements.

Statements regarding current conditions, trends, or expectations in connection with the financial markets or the global economy are based on subjective viewpoints and may be incorrect.

Indices are shown for illustrative purposes only, are unmanaged, and do not take into account market conditions or the costs associated with investing. Further, Connecticut Wealth Management (CTWM) strategies may deploy investment techniques and instruments not used to generate index performance. For this reason, the performance of CTWM and the indices are not directly comparable.