In the latest update from CTWM’s Investment Committee, John Shanley, Partner & Managing Advisor, and Josh Sweeney, Director of Investments, answer three questions that have been top of mind for our advisors, clients, and all who stay in tune with market events.

- 2024 Market Outlook & Election Impact

- What about Commercial Real Estate?

- Why Invest Internationally?

2024 Market Outlook & Election Impact

Keeping with the theme of “broken record,” in the equity market we are currently seeing records being broken in the form of continued new highs accompanied by higher valuations for the S&P 500.

While hitting all-time highs can be viewed as a positive, certain aspects of the market may still feel “broken,” with market strategists calling for a recession and the continuation of multiple overseas conflicts.

While there is risk, the overall equity market has continued to prove itself for those who have remained invested for the long term. As the adage goes, bull markets climb a wall of worry.

With a polarizing election on the horizon, we’ve received more questions about what this means for portfolios and the market in general. CTWM works with many market research firms that analyze data from previous election cycles in market performance, economic growth, and investor sentiment.

From our viewpoint, much of this research indicates that markets tend to go up no matter which party is in office. Additionally, while markets can experience short-term volatility during election seasons, we have found that growth in the stock market and GDP continues regardless of which party controls the U.S. government.

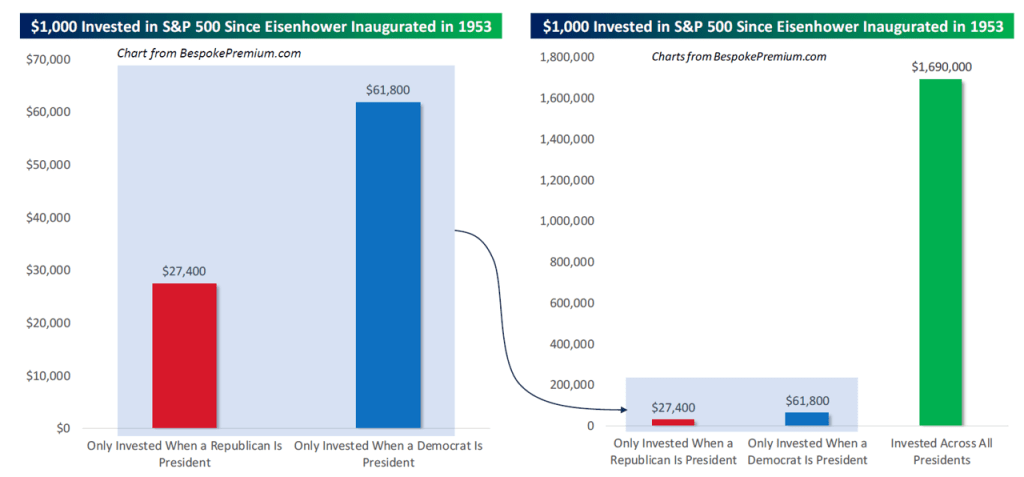

The chart below shows market performance from today dating all the way back to when Dwight Eisenhower was in office. What we find is trying to get in or out of the market based on presidential party isn’t a prudent strategy. Remaining focused on the long-term and investing through full cycles is where investment success lies.

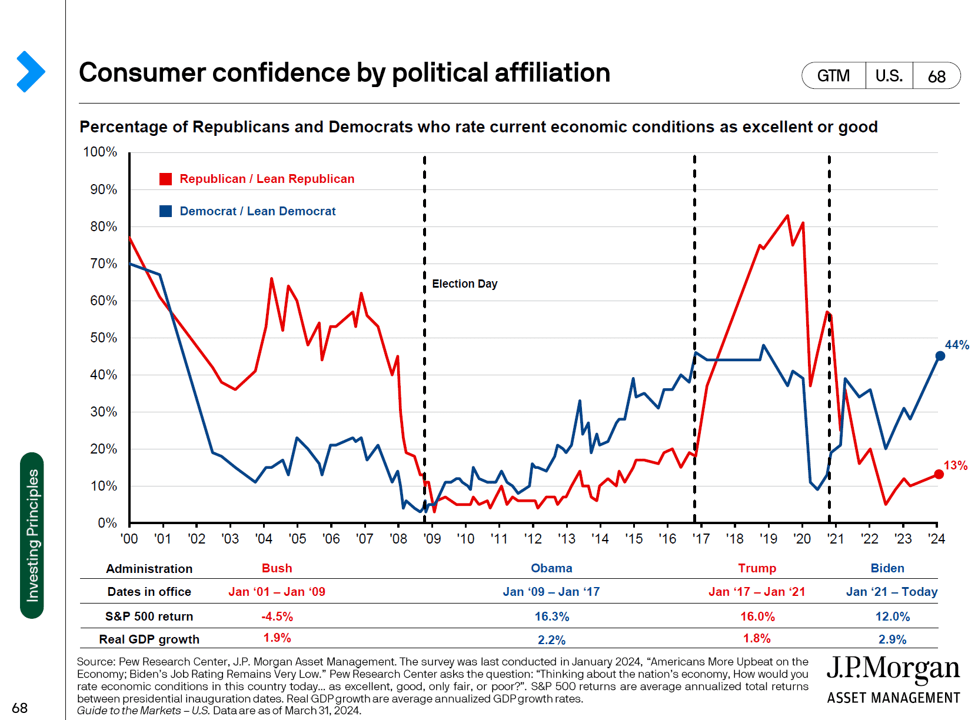

In a polarized world with many disparate views, it can be challenging for investors to not let politics and investing overlap when making financial decisions. Research has highlighted the biggest factor impacted by past elections is consumer sentiment (how one feels about the market) based on which political party you support, as shown in the chart below.

The statistics at the bottom of the chart show remaining invested has been the right answer across all political terms. These reasons contribute to our dedication to financial planning. Especially in today’s environment, we keep a focus on individual cash needs to provide a buffer during times of market volatility.

We pride ourselves on focusing on what matters most to our clients and helping them navigate whatever unforeseen circumstances impact investable markets. These statements may sound like a “broken record” given how often we cite them, but we do believe these philosophies are the key to financial success.

What about Commercial Real Estate?

Another topic of much discussion today is commercial real estate – how do we define this market sector and why do we continue to hold it in CTWM target portfolios?

Due to remote work becoming the norm during the COVID pandemic, many businesses shifted their business model to either a fully remote or hybrid work model. Despite original estimates that we would “return to normalcy,” the workplace environment has continued to remain flexible, causing a difficult market for the office space subsector, especially in major metropolitan areas.

So, the question is – given these headwinds, why is it still a part of our target portfolio?

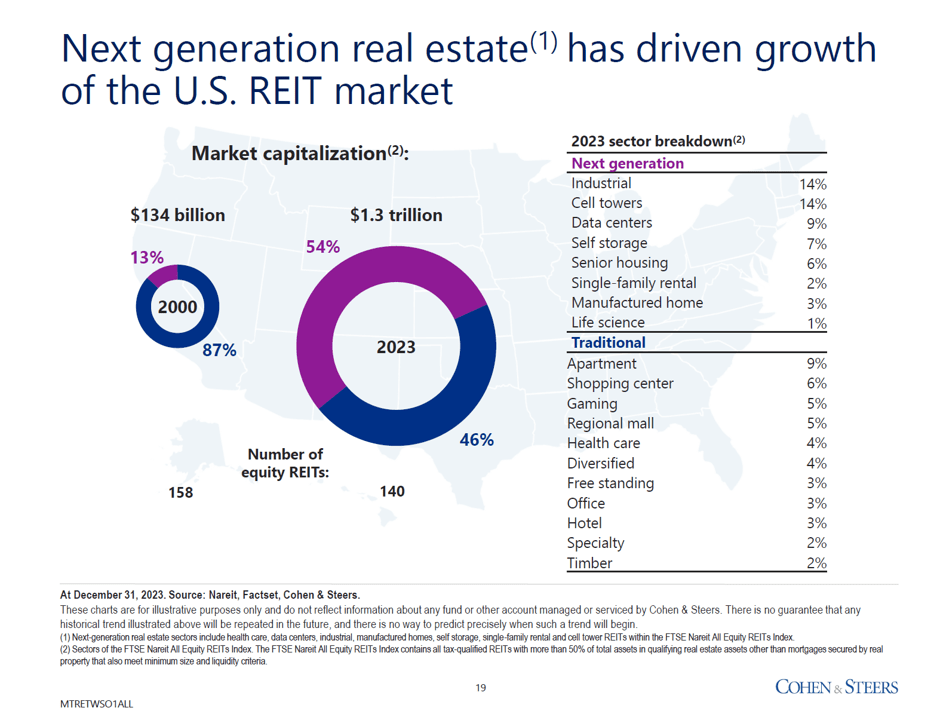

Looking at the most widely used real estate index, we can look at a breakdown of the sub-sectors that comprise the asset class of commercial real estate.

Surprisingly, although it gets a large market share of discussion time, office space realty is only 3% of the overall index. Larger pieces of this sector include industrial, cell towers, and data centers – all key areas that are driving innovation over the recent years and growth in the equity markets.

While there is risk in commercial real estate, there is also opportunity. Real estate has proven to be a great diversifier over long-term time periods and has been a reliable source of steady income, which is why CTWM continues to hold it in our portfolios.

Why Invest Internationally?

Another common question from clients is around the merits of investing internationally.

According to data from the MSCI EAFE versus the MSCI USA index, the U.S. has outperformed international stock performance over the last 14 years by a sizeable margin. So why continue to invest?

One of the principle fundamental goals of investing is simple at its core – buy low and sell high. Today, international companies are trading at deep discounts due to the headline risk from geopolitical events. Remember, we are not buying an individual country but instead buying a company based on its merits.

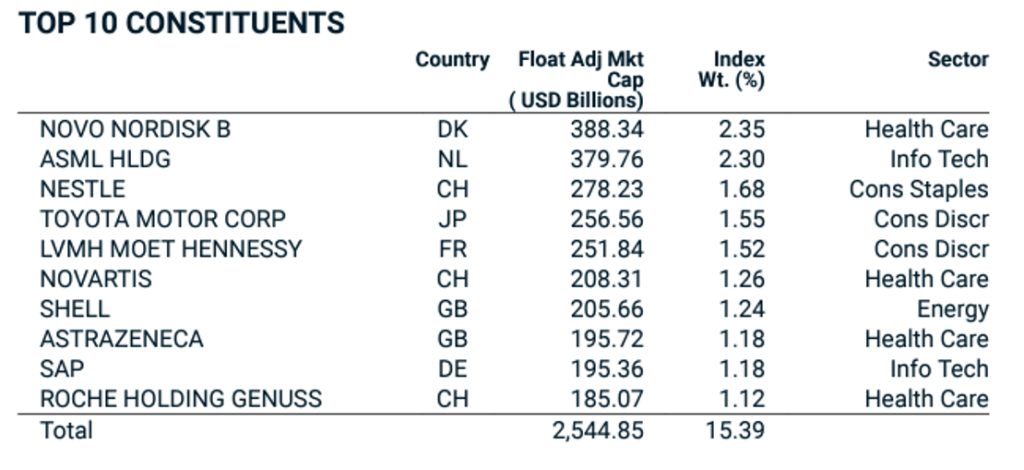

Looking at the top 10 constituents in the MSCI EAFE Index – one of the most widely referenced indices for international developed countries – you see companies like Novo Nordisk, Nestle, Toyota, and Astrazeneca. Each of these companies are global firms with attractive and profitable income streams, and trade at deep discounts simply due to the location of their headquarters.

Like real estate, a core tenet of CTWM’s investment philosophy is diversification. As U.S. valuations get higher and higher, having exposure in areas of the market that are at attractive valuations on a relative basis, helps to diversify some of the country-specific risks that exist in the market today.

Wrapping Up

Today’s market environment has no shortage of areas that spark concern due to overvaluation, geopolitical conflicts, election fears, and a changing world marketplace. However, attempting to time the market, whether it be moving in and out of cash or certain industries, has proven to be a losing game in the long term.

CTWM continues to focus on remaining invested and diversified over the long term, evaluating market trends over 3-to-5-year periods, identifying short-term cash needs, and managing portfolios in line with each client’s personalized financial plan.

Have questions or want to learn more about Connecticut Wealth Management’s services? Contact our advisors at 860-470-0290 or by completing the form.